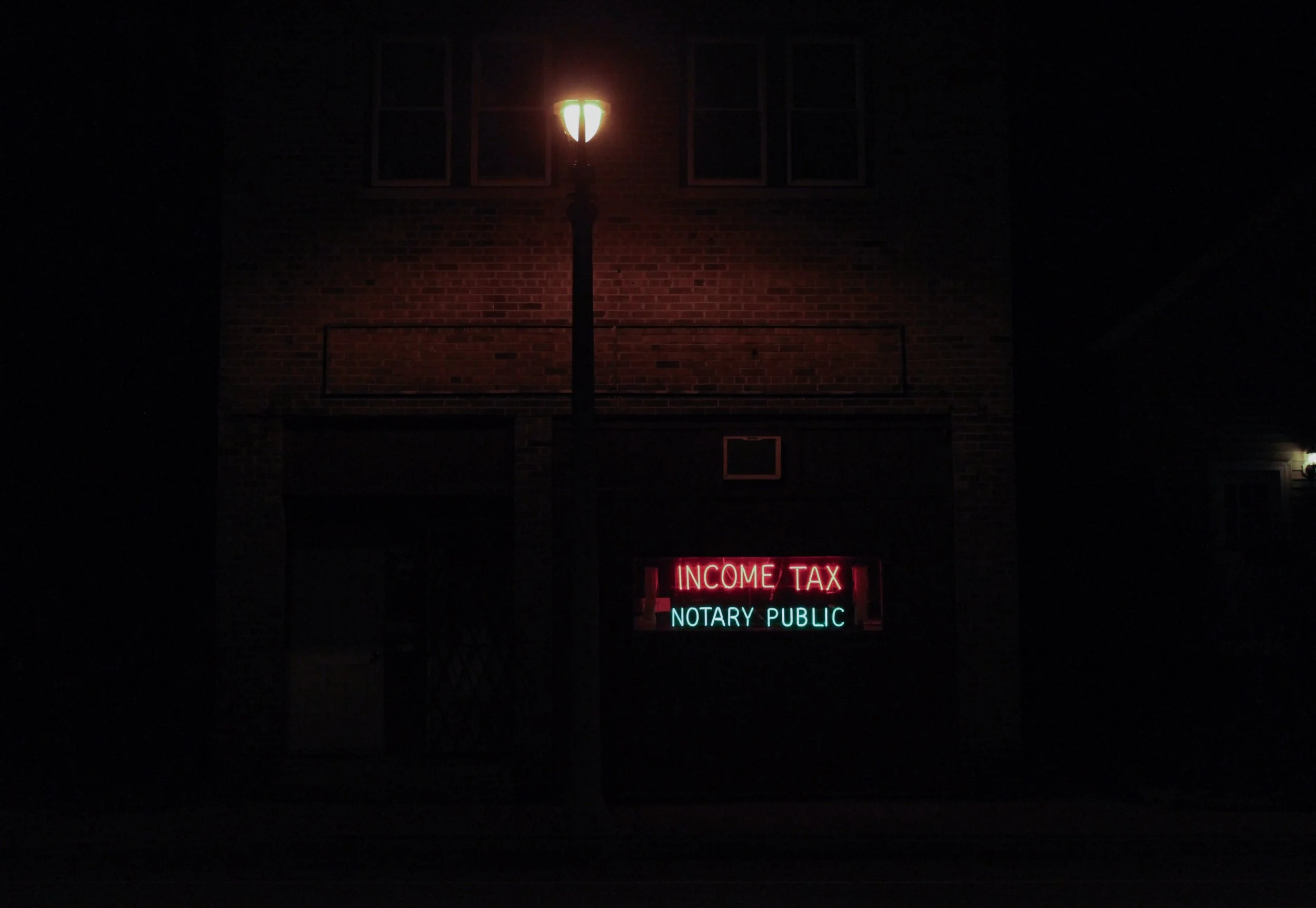

Taxes

The purpose of tax planning is to minimize your tax obligations so more of your money is there to achieve your goals. Managing taxes is one of the most important parts of personal finance.

The IRS has announced the 2022 income tax tables and other adjustments for inflation. Plan ahead to lower your 2022 income taxes and lower lifetime taxes through multi-decade tax planning impacting Roth conversion strategies, the sale of major assets, passing down family businesses, or dealing with Required Minimum Distributions.

The IRS has announced the 2021 income tax tables and other adjustments for inflation. Plan ahead to lower your 2021 income taxes and lower lifetime taxes through multi-decade tax planning impacting Roth conversion strategies, the sale of major assets, passing down family businesses, or dealing with Required Minimum Distributions.

The IRS has announced the 2020 income tax tables and other adjustments for inflation. Plan ahead to lower your 2020 income taxes and lower lifetime taxes through multi-decade tax planning impacting Roth conversion strategies, the sale of major assets, passing down family businesses, or dealing with Required Minimum Distributions.

Yes, getting a paper divorce can help you financially but it can also be a financial negative depending on your personal situation. Below are a few of the consideration that immediately spring to mind, which you will want to explore.

It is possible you will have to pay some additional taxes due to your Social Security being taxed. Up to 85% of your Social Security benefits can become taxable depending on how much you earn in total. The formula is based on . . . .

For address changes you would use IRS Form 8822, which will allow you to change your address anytime during the year. It is good practice to always submit Form 8822 as the method for changing your address, and not rely . . . .

While generally a trust cannot get the Principal Residence Exclusion, it is possible if the trust is set up correctly and the circumstances are correct. The devil, as always, is in the details and you will want to get professional . . . .

Federal taxes are progressive taxes, meaning you start getting taxed at a low rate, then, as you earn more money, the additional money you earn is taxed at a higher rate. The way the calculation works, everyone pays the same . . . .

The key difference between the Married Filing Separately verses the Filing Single status is if you are legally married on the last day of the tax year (December 31st for most people). No other day during the year matters for . . . .

The Head of Household filing status is a special status which offers preferential tax brackets for some single individuals. The brackets are between the Single filing brackets and the Married Filing Jointly brackets . . . .

Don't assume this year's taxes and tax deductions will be similar to last year's taxes. The tax reform bill, which passed in December 2017, gutted most of the deductions and maimed many of the rest. Just like characters in . . . .

The Standard Deduction is the amount every taxpayer can deduct from their income, and with the changes to the tax law, more taxpayers than ever will now be taking the Standard Deduction. A lesser known fact about the Standard Deduction, however, is it can be increased for those over age 65 or who are blind.

The IRS has announced the 2019 income tax tables and other adjustments for inflation. Get a jump start on your taxes and plan ahead to lower your 2018 income taxes.

While it currently only applies to one company, the IRS has opened the door for companies to being offering an employee benefit whereby workers have an opportunity to both pay down student loan debt and save for retirement with the same dollars.

If you're excited about getting a tax refund, imagine how excited you would be if you could double ot triple the value of the refund. Here are a few smart ideas to use your tax refund for that will amplify the boost to your cash flow.

Financially savvy people know the best time to start on next year’s taxes is the beginning of this year. Your tax return is a historical document about what happened last year, so there is very little you can plan and change. Next year, however, hasn’t happened giving you control over the tax planning environment.

Waiting until April to do your taxes could cost you more than you think. Submitting your taxes early isn’t just for those expecting a big refund. Advantages of early filing include easier money management if you owe additional taxes, opportunities for greater deductions, and reducing the risk of identity theft and fraud.

Updates to the tax code which go beyond the new tax brackets and changes to deductions. The new code will impact everything from divorce to education savings. And everyone from parents of disabled children to real estate investors.

After lots of argument and fighting, the Tax Cuts and Jobs Act has been passed. Whether you like the tax reform bill or hate it, the reality is we have a new tax code for the foreseeable future. Here are key components of the new tax code which impact most taxpayers.

The 2018 inflation-indexed changes gave increases for workplace retirement plan contribution limits, while individual retirement accounts saw little change. Here are the maximums you can contribute to your retirement accounts in 2018.

The IRS has announced the 2018 income tax tables and other adjustments for inflation. Get a jump start on your taxes and plan ahead to lower your 2018 income taxes.

The IRS is trying to put the scare into real estate investors looking to push the timelines for 1031 exchanges. If you own investment real estate, a 1031 exchange can save you significant taxes, but the IRS is signalling it will aggressively enforce the rules.

The President's proposed tax revision may be interesting water-cooler talk, but you shouldn't spend much time on it. As the proposed individual income tax reforms are far from being law, there is nothing you can do to adjust your tax strategy in preparation. Still, it is fun to dissect the good and bad of the President's plan.

Your goal in filing your taxes should not be to get to a big tax refund so you can use the money all year long. You can use your tax return to help you estimate next year's taxes and withhold only what you need to pay your taxes. Withholding less will increase your take home pay each pay period.

Your tax planning options are based on understanding and substantiating the expenses which may qualify for a tax deduction. Keeping records and documents of any expenses related to the categories in this article will help your tax preparer to maximize your deductions each year.

The benefits of giving to others are many, including health, happiness, and tax deductions. The complexities of the tax code, however, can cause unhappy surprises for those who donate without proper planning. Make sure you understand the answers to these questions before donating any property, including cars, personal items, stocks, or real estate.

Reviewing your tax deductions in the last few months of the year can provide you with some extra tax savings. By moving tax deductions forward or backward in time, you can maximize the benefits of your tax deductions, whether you itemize or take the standard deduction.

Here are a few smart ideas to use your tax refund for that will amplify the boost to your cash flow.

The IRS has announced the 2022 income tax tables and other adjustments for inflation. Plan ahead to lower your 2022 income taxes and lower lifetime taxes through multi-decade tax planning impacting Roth conversion strategies, the sale of major assets, passing down family businesses, or dealing with Required Minimum Distributions.